Financial worries can have a negative impact on both an employee’s general wellbeing and work performance, so it makes sense for employers to educate staff about the financial benefits available to them and how to manage their finances. Online platforms are one of the most effective ways of providing this advice.

Features

Money matters

For employers, their employees’ wellbeing is a topic of rising importance, inevitably and rightly so given the Covid-19 situation. Even before Covid-19 though, many employers were realising that an employee’s wellbeing does not exist in isolation from their employment.

Even with the best intentions to keep work and home life separate, employees must necessarily bring all of themselves to work. If their wellbeing is off-kilter, however, they are unlikely to be bringing all of themselves to work for you.

Despite not being an exact picture, we can usefully talk about an individual’s wellbeing as falling across a few broad areas: physical, mental, social and financial. Importantly, we have to recognise that deficits in one area of wellbeing are highly likely to have an impact on other areas.

Photograph: iStock / ronstik

Photograph: iStock / ronstik

Reflecting on our own experiences of being sick or over-stressed will make it clear that employees with below par wellbeing will likely be below par in their work. While a lack of physical wellbeing is likely to have immediate and visible impacts on performance, less obvious, but potentially no less damaging, are the impacts of a lack of financial wellbeing.

A sobering statistic from the Money and Pensions Service (MaPS), before the Covid-19 crisis, was that over 11 million UK employees had less than £100 in emergency savings, and only 44 per cent have over £500 to fall back on. Even without systemic financial uncertainty created for many by the pandemic’s effects, this demonstrates how fragile the financial resilience of many employees is.

Additionally, employees are having other struggles through navigating the financial world, from debt, to adequate pension savings, to managing daily expenses; all of which are causing 35 per cent of the population to feel some form of additional mental stress from their finances.

Financial wellbeing and the individual

Achieving financial wellbeing, and hence reducing the stresses and strains referenced above, often requires help. Realistically humans aren’t ‘designed’ to be inherently good with money, and few of us have been taught to be. The skills and patterns, and the necessary ways of thinking about how we use our money often run counter to our natural instincts to prioritise the short- over the long-term.

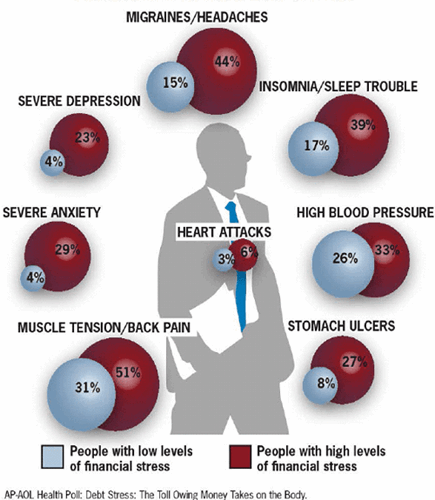

AP-AOL Health Poll: Debt Stress: The Toll Owing Money Takes on the Body.

AP-AOL Health Poll: Debt Stress: The Toll Owing Money Takes on the Body.

When Mercer Marsh Benefits (MMB) Workplace Education educates employees about their financial wellbeing, we are ultimately looking to put them in a position where they can confidently claim security in four ‘pillars’: Control; Capacity; Freedom; and Goals. These are broadly similar to the MaPS definition in the box on this page – to have control over your day-to-day finances, to have the capacity to absorb a financial shock, to have the freedom to make choices and to make plans for the future, and to be on track to meet your financial goals.

An individual whose financial situation ticks all those boxes has a strong foundation both now and for their future.

Financial wellbeing and the employer

It would be easy, and not unreasonable, for an employer to claim that their primary responsibility for an individual’s financial wellbeing is to pay the individual for their work. How an employee then uses, spends or saves their pay is their choice.

However, as we’ve discussed there are implications for employers when employees are struggling financially. Furthermore, there is an interesting parallel to be drawn when we consider health and safety.

Setting aside the (entirely necessary) legislative and moral components of health and safety, we should consider that health and safety is firmly about good business. It is beneficial in managing actual financial risks: an injured employee might delay a project; unsafe or shortcut working might result in damage or defects needing costly remedial work and so forth.

Similarly, even if we set aside an employer’s desire to look after their employees, the financial wellbeing of employees can represent a genuine risk, and mitigating against that risk is simply good business.

Beyond the stress-sickness link, we can talk confidently about distraction, disengagement, presenteeism and absenteeism, and even criminality as possible outcomes of an employee’s negative financial situation.

While this applies across all industries, we’ll use the construction industry as an example where those outcomes’ effects can be immediate: an employee worrying about their debts with an unpaid bill coming due, might not be focused on the job in hand. Depending on their role, the outcomes could range from simple delays or wasted material, all the way to dangerous, or even disastrous mistakes.

It’s easy to make the connection between the risk of a distracted employee in an inherently complex and physical environment like a construction site. But, staying with our construction example, when we broaden our understanding of business ‘risk’ to include reputation, insurance premiums or relationships with workforce and sub-contractors, we can all picture the damage that a distracted, disengaged or desperate clerical employee could do by wrongly billing a customer, making errors in payroll or when paying suppliers.

It should be recognised therefore that, for employers in all industries, supporting employees’ financial wellbeing can protect the employer against risk, invite better personal performance at work and generally improve their employees’ lives.

Benefits, financial wellbeing and technology

Employers essentially have to offer a pension these days and many will offer a broader suite of benefits from the very common death in service, to the less common Workplace ISA or salary advance. The extent to which the connection is made between the benefit offered and a financial need being met will often correlate with how well that employer educates their workforce in this regard. Forward thinking employers will go further and secure education for their workforce on positive financial health outside of just employee benefits.

How a person learns most effectively is an individual thing. There will always be a strong place in any education provision mix for face-to-face events. Things like being able to look a person in the eye and make sure they’re following the topic, or their being able to ask questions and receive answers in the moment of learning, are aspects both important and valuable to effective education.

But logistical challenges, such as releasing individuals for training, particularly when a job or project is time-sensitive or social distancing prevents group events, can be a very real barrier for employers who want to support their staff. However, we are in the fortunate position that advances in technology have changed what can be done, who can do it, where and when, and for how much.

The common availability of good broadband internet and the near ubiquity of personal computing devices (PC, laptop, tablet, smartphone) means that, more than ever before, people can access digital content, tools and resources when it is convenient for them.

Improvements in virtual conferencing mean that effective events can be held for staff without needing to bring them together, while still offering ample opportunity for rich interpersonal interaction.

E-learning is interactive, and can be picked up, put down and resumed as needed. Flexible deployment models and common standards mean that courses can live within a company’s infrastructure or externally where they can be purchased for individual learners with no further commitment. Educational resources now exist that can be accessed by learners from any device, anywhere with decent internet– truly 24x7x365 education.

Lessons learned in design and in how people interact with e-learning mean that it is more approachable, even for people who consider themselves non-technical.

Open banking, technology-based money management tools bring individuals a level of visibility and personal control over their finances that has literally never existed before. Single applications are available that provide visibility of spending and savings across multiple accounts, savings vehicles and pensions.

Digital advice services allow for professional regulated financial advice to be provided at a fraction of the traditional cost, and social media-inspired wellbeing platforms can be deployed by employers to effectively drive up engagement with wellbeing programmes.

For employers, sole traders, one-man-bands and anyone who has found financial education support costly, difficult or awkward to obtain for them or their employees, the evolution of technology has brought much of this genuinely within reach.

And by grasping this opportunity employers and employees alike can benefit from better individual financial wellbeing.

Join the MMB Workplace Education team for the free Being Well Together: Financial Wellbeing virtual conference on 18 May. Register here

For more information on the Being Well Together programme see: beingwelltogether.org

Matt Stafford-Clack is Digital and retirement education leader at Mercer Marsh Benefits Workplace Education

FEATURES

How to build circular economy business models

By Chloe Miller, CC Consulting on 07 April 2025

Widespread adoption of a circular economy model by business would ensure greater environmental and economic value is extracted and retained from raw materials and products, while simultaneously reducing carbon emissions, protecting the environment and boosting business efficiency and reputation.

What does the first year on an accelerated net zero path have in store for UK businesses?

By Team Energy on 07 April 2025

The UK is halfway to net zero by 2050 and on a new, sped-up net zero pathway. In light of this, Graham Paul, sales, marketing & client services director at TEAM Energy, speaks to TEAM Energy’s efficiency and carbon reduction experts about the future of energy efficiency and net zero in the UK.

Aligning organisational culture with sustainability: a win, win for the environment and business

By Dr Keith Whitehead, British Safety Council on 04 April 2025

The culture of an organisation is crucial in determining how successfully it implements, integrates and achieves its sustainability and environmental goals and practices. However, there are a number of simple ways of ensuring a positive organisational culture where everyone is fully committed to achieving excellent sustainability performance.